Let TiM Help at Tax Time

It’s almost tax season. Once again, it’s time to check those receipts and call those accountants. Fortunately, the TiM team is here to help make sure you’re prepared.

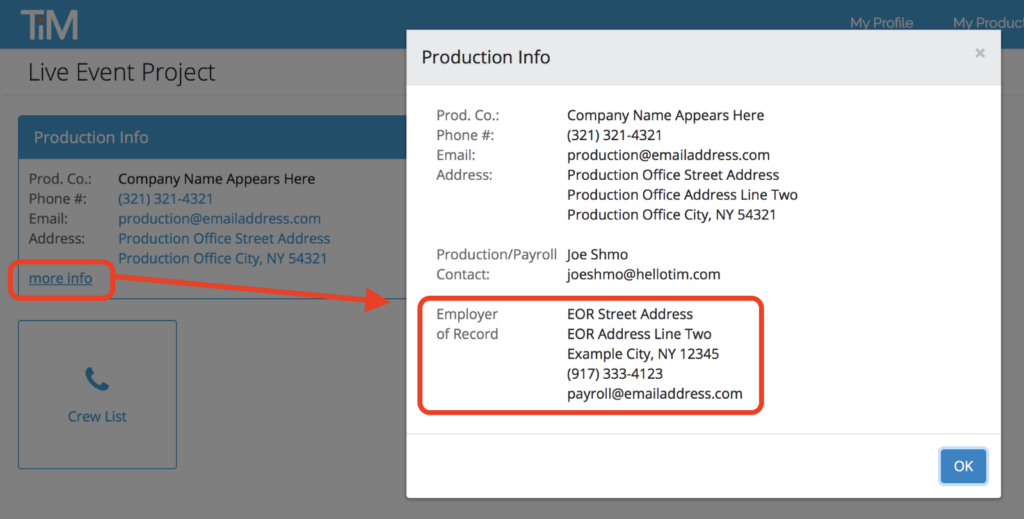

Tax documents (like your W-2) are provided by your Employer of Record (EOR). If these materials aren’t automatically distributed, you’ll just need to reach out and request them from your EOR. Their contact information is easily accessible on the TiM platform (just look in the “Production Info” section of each project).

For example:

You can also find your Employer of Record information on start work documents like WTPA notices, W-4s, and W-9s. If you still have questions about where to find your EOR information for things like filing for unemployment or receiving copies of timely tax materials, go here.

For Cast & Crew, CAPS, and Media Services employees

Cast & Crew, CAPS, and Media Services employees can access their EOR and W-2 information through the MyCast&Crew portal here. If you’ve been paid by one of these companies in the past and have not yet set up your personalized hub, do it now by visiting the MyCast&Crew registration page. Once you’re signed up, you’ll be able to access all your important personal, professional, and tax documents anytime you need them.

Helpful tips for signing up

Already a TiM user? Then good news: you can use the same login credentials for MyCast&Crew. Both systems leverage OKTA as a single sign-on solution. Once you’re registered, you can sign up for direct deposit, update your preferred payment information, and modify your tax withholding, all from the convenience of a personalized hub. Simplify the process of storing and managing your personal and professional materials with MyCast&Crew.

New to the platform? We’ve got your back. Here are some examples of the things you can do through your custom portal:

We’re here to help

Questions? Want more information? Reach out to the Employee Help Desk at [email protected] or 888.570.4650.

If you have questions, I’m here to help.